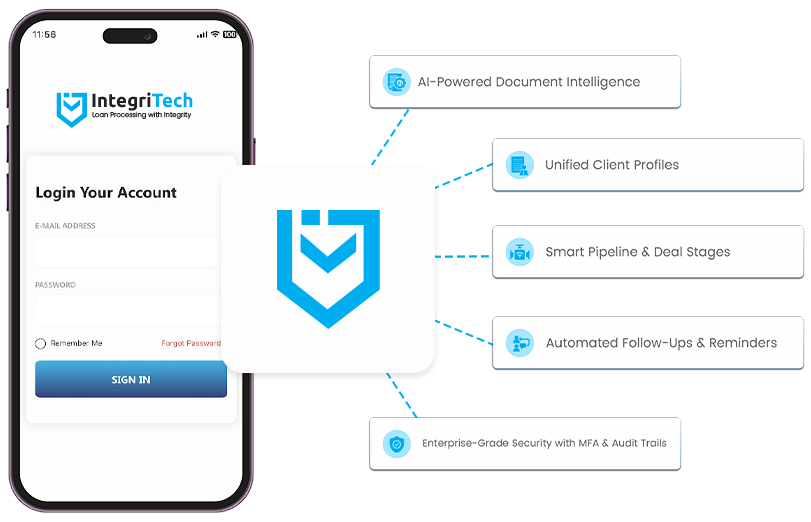

Turn hours of document review into minutes with automated extraction, verification, and fraud detection.

Track every borrower journey with customizable stages that keep deals moving and teams aligned.

Safeguard sensitive data with bank-level encryption, multi-factor authentication, and complete visibility into every action.

We don’t just handle documents; we tie them to your customer records. Our built-in CRM capabilities allow you to track each client’s application progress, notes, and communications alongside their documents. Everything centralized in one place – improving collaboration across your team and ensuring you have full context on every deal.

Your lending criteria, automated. Define your credit policy rules (debt-to-income

thresholds, minimum balances, red-flag transactions, etc.) in our system. Our platform will automatically analyze documents against your criteria – highlighting whether an applicant fits your credit box or where there are exceptions. This level of customization turbocharges your underwriting process, giving you tailored insights rather than one-size-fits-all metrics.

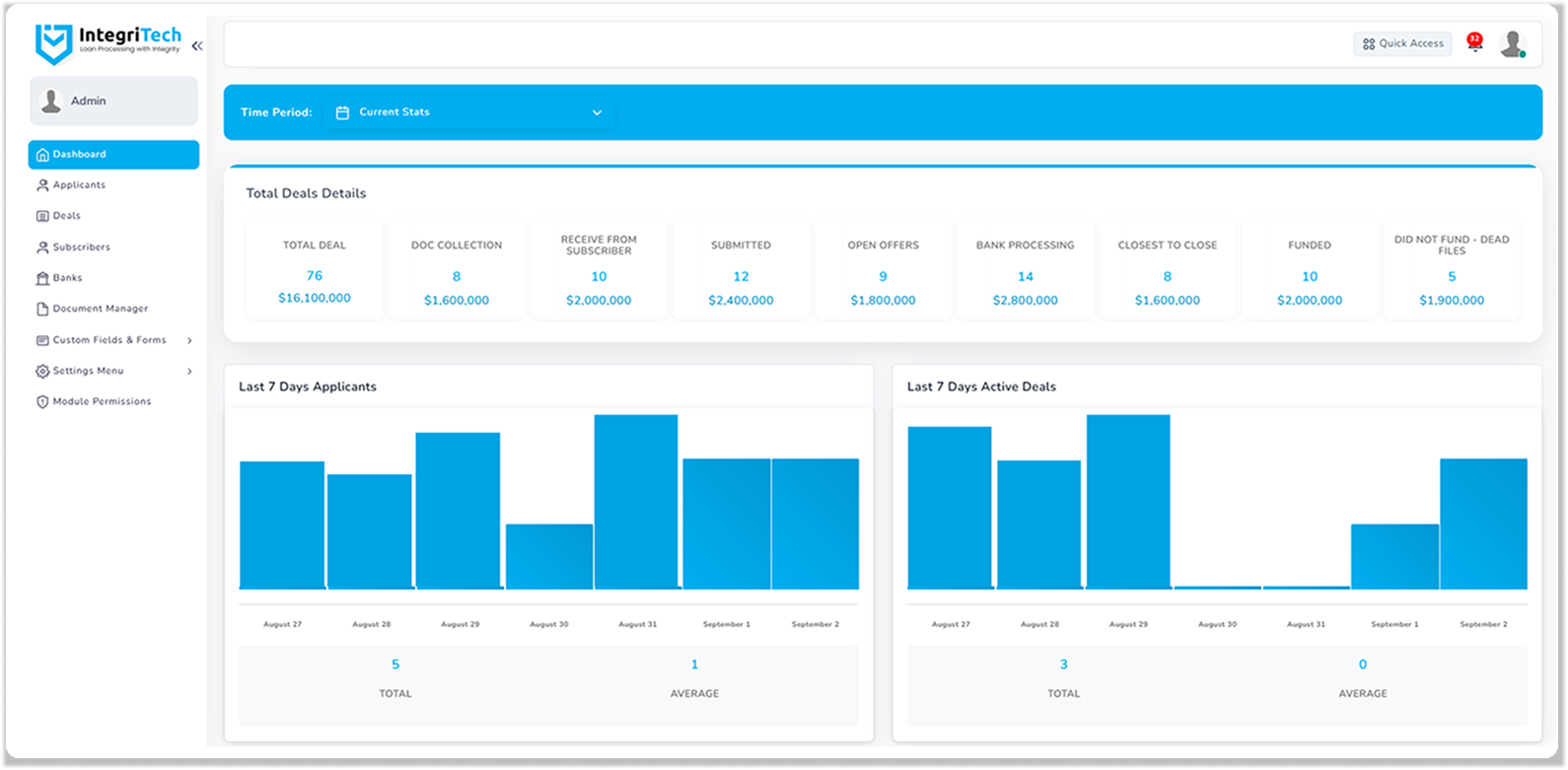

Manage your entire portfolio with ease. Our solution isn’t just for one-off reviews – it scales to thousands of accounts. The Portfolio Dashboard gives you a bird’s-eye view of all active loans or client files, their document status, and any pending updates. We bring true portfolio management features that legacy document tools lack, helping you stay proactive with your clients in perpetuity.

Our technology turns documents into actionable insights, capturing details and flagging risks automatically to keep your team focused on what matters most.

All documents are stored in our secure Document Management System, organized and indexed for instant retrieval. Our superior document housing and retrieval means information is always at your fingertips – no more digging through email attachments or shared drives.

We don’t just handle documents; we tie them to your customer records. Our built-in CRM capabilities allow you to track each client’s application progress, notes, and communications alongside their documents. Everything centralized in one place – improving collaboration across your team and ensuring you have full context on every deal.

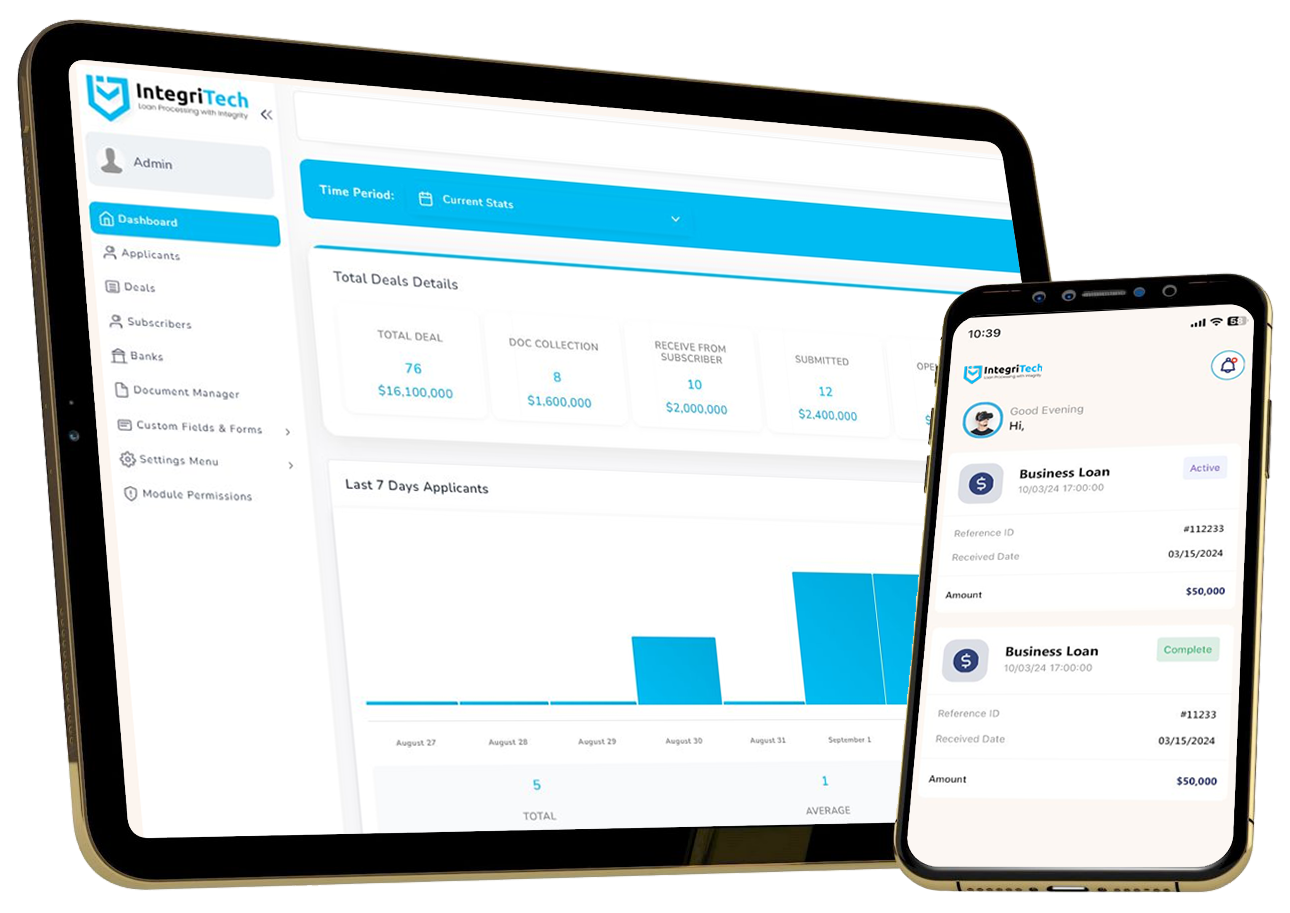

Our platform automates financial document review and centralizes your data combining the power of artificial intelligence with built‑in CRM and portfolio management.

Our technology reads and extracts every key detail with human-level accuracy, then flags anomalies or fraud indicators automatically. Free your team from data entry and let them focus on decisions that matter.

Cut review times from days to minutes, boost accuracy, and never lose track of a document again.

Our technology reads and extracts every key detail with human-level accuracy, then flags anomalies or fraud indicators automatically. Free your team from data entry and let them focus on decisions that matter.

Say goodbye to scattered files and siloed storage. All documents are stored in our secure Document Management System, organized and indexed for instant retrieval. Our superior document housing and retrieval means information is always at your fingertips – no more digging through email attachments or shared drives.

Say goodbye to scattered files and siloed storage. All documents are stored in our secure Document Management System, organized and indexed for instant retrieval. Our superior document housing and retrieval means information is always at your fingertips – no more digging through email attachments or shared drives.

We don’t just handle documents; we tie them to your customer records. Our built-in CRM capabilities allow you to track each client’s application progress, notes, and communications alongside their documents. Everything centralized in one place – improving collaboration across your team and ensuring you have full context on every deal.

Your lending criteria, automated. Define your credit policy rules (debt-to-income

thresholds, minimum balances, red-flag transactions, etc.) in our system. Our platform will automatically analyze documents against your criteria – highlighting whether an applicant fits your credit box or where there are exceptions. This level of customization turbocharges your underwriting process, giving you tailored insights rather than one-size-fits-all metrics.

Manage your entire portfolio with ease. Our solution isn’t just for one-off reviews – it scales to thousands of accounts. The Portfolio Dashboard gives you a bird’s-eye view of all active loans or client files, their document status, and any pending updates. We bring true portfolio management features that legacy document tools lack, helping you stay proactive with your clients in perpetuity.

Our technology reads and extracts every key detail with human-level accuracy, then flags anomalies or fraud indicators automatically. Free your team from data entry and let them focus on decisions that matter.

Say goodbye to scattered files and siloed storage. All documents are stored in our secure Document Management System, organized and indexed for instant retrieval. Our superior document housing and retrieval means information is always at your fingertips – no more digging through email attachments or shared drives.

We don’t just handle documents; we tie them to your customer records. Our built-in CRM capabilities allow you to track each client’s application progress, notes, and communications alongside their documents. Everything centralized in one place – improving collaboration across your team and ensuring you have full context on every deal.

Your lending criteria, automated. Define your credit policy rules (debt-to-income thresholds, minimum balances, red-flag transactions, etc.) in our system. Our platform will automatically analyze documents against your criteria – highlighting whether an applicant fits your credit box or where there are exceptions. This level of customization turbocharges your underwriting process, giving you tailored insights rather than one-size-fits-all metrics.

Manage your entire portfolio with ease. Our solution isn’t just for one-off reviews – it scales to thousands of accounts. The Portfolio Dashboard gives you a bird’s-eye view of all active loans or client files, their document status, and any pending updates. We bring true portfolio management features that legacy document tools lack, helping you stay proactive with your clients in perpetuity.

Quam platea eu pharetra tellus non nec primis suspendisse turpis nostra magnis

support@yourdomain.tld hello@yourdomain.tld

Your lending criteria, automated. Define your rules, such as debt-to-income thresholds, minimum balances, or red-flag transactions, and let our AI instantly assess whether applicants fit your credit box. No more one-size-fits-all: get insights tailored to your lending strategy.

Scale beyond individual reviews. Monitor thousands of accounts at once with real-time status tracking, exception alerts, and performance insights. Our portfolio view ensures you stay proactive, not reactive, with client relationships.

24/7 borrower engagement. Our AI chatbot answers loan questions, guides applicants through document uploads, and provides real-time status updates, freeing your team to focus on closing deals instead of chasing follow-ups.

IntegriTech delivers a smoother borrower journey by automating reminders and status updates. Clients always know what’s next, reducing delays and miscommunication, while your team benefits from faster closings and fewer manual tasks.

support@yourdomain.tld hello@yourdomain.tld

Pellentesque lacus posuere ultricies dolor curabitur ultrices sit bibendum ipsum ornare fermentum

Pellentesque lacus posuere ultricies dolor curabitur ultrices sit bibendum ipsum ornare fermentum

Pellentesque lacus posuere ultricies dolor curabitur ultrices sit bibendum ipsum ornare fermentum

Pellentesque lacus posuere ultricies dolor curabitur ultrices sit bibendum ipsum ornare fermentum

Si lorem blandit congue maecenas quisque conubia lacus. Viverra turpis sapien letius malesuada tempus. Condimentum semper quisque fringilla pretium praesent arcu a ultrices vivamus nibh.

Si lorem blandit congue maecenas quisque conubia lacus. Viverra turpis sapien letius malesuada tempus. Condimentum semper quisque fringilla pretium praesent arcu a ultrices vivamus nibh.

Si lorem blandit congue maecenas quisque conubia lacus. Viverra turpis sapien letius malesuada tempus. Condimentum semper quisque fringilla pretium praesent arcu a ultrices vivamus nibh.

Si lorem blandit congue maecenas quisque conubia lacus. Viverra turpis sapien letius malesuada tempus. Condimentum semper quisque fringilla pretium praesent arcu a ultrices vivamus nibh.

Si lorem blandit congue maecenas quisque conubia lacus. Viverra turpis sapien letius malesuada tempus. Condimentum semper quisque fringilla pretium praesent arcu a ultrices vivamus nibh.

Si lorem blandit congue maecenas quisque conubia lacus. Viverra turpis sapien letius malesuada tempus. Condimentum semper quisque fringilla pretium praesent arcu a ultrices vivamus nibh.

Si lorem blandit congue maecenas quisque conubia lacus. Viverra turpis sapien letius malesuada tempus. Condimentum semper quisque fringilla pretium praesent arcu a ultrices vivamus nibh.

Si lorem blandit congue maecenas quisque conubia lacus. Viverra turpis sapien letius malesuada tempus. Condimentum semper quisque fringilla pretium praesent arcu a ultrices vivamus nibh.

Si lorem blandit congue maecenas quisque conubia lacus. Viverra turpis sapien letius malesuada tempus. Condimentum semper quisque fringilla pretium praesent arcu a ultrices vivamus nibh.

Si lorem blandit congue maecenas quisque conubia lacus. Viverra turpis sapien letius malesuada tempus. Condimentum semper quisque fringilla pretium praesent arcu a ultrices vivamus nibh.

Si lorem blandit congue maecenas quisque conubia lacus. Viverra turpis sapien letius malesuada tempus. Condimentum semper quisque fringilla pretium praesent arcu a ultrices vivamus nibh.

Si lorem blandit congue maecenas quisque conubia lacus. Viverra turpis sapien letius malesuada tempus. Condimentum semper quisque fringilla pretium praesent arcu a ultrices vivamus nibh.