Quam platea eu pharetra tellus non nec primis suspendisse turpis nostra magnis

Quam platea eu pharetra tellus non nec primis suspendisse turpis nostra magnis

Quam platea eu pharetra tellus non nec primis suspendisse turpis nostra magnis

Quam platea eu pharetra tellus non nec primis suspendisse turpis nostra magnis

Quam platea eu pharetra tellus non nec primis suspendisse turpis nostra magnis

Quam platea eu pharetra tellus non nec primis suspendisse turpis nostra magnis

Our technology turns documents into actionable insights, capturing details and flagging risks automatically to keep your team focused on what matters most.

All documents are stored in our secure Document Management System, organized and indexed for instant retrieval. Our superior document housing and retrieval means information is always at your fingertips – no more digging through email attachments or shared drives.

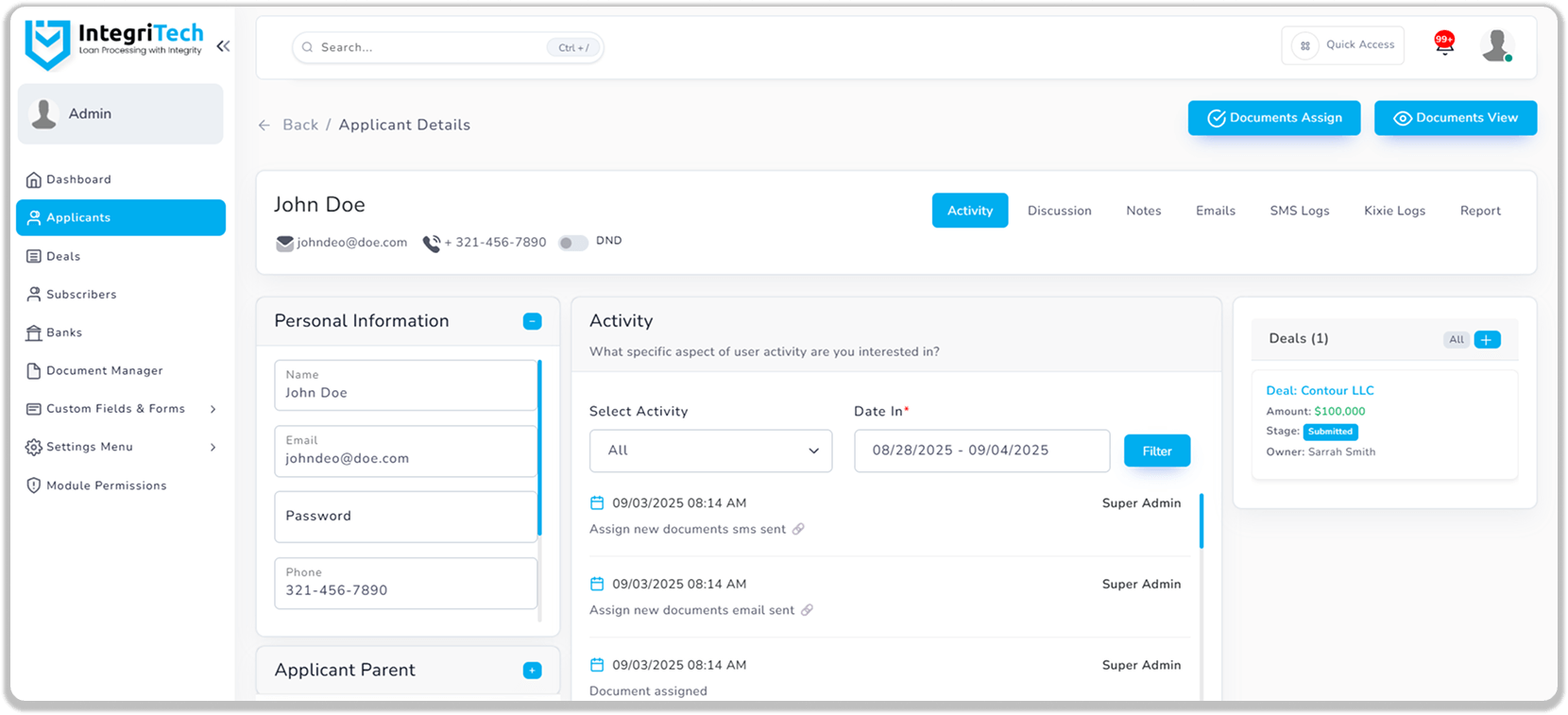

We don’t just handle documents; we tie them to your customer records. Our built-in CRM capabilities allow you to track each client’s application progress, notes, and communications alongside their documents. Everything centralized in one place – improving collaboration across your team and ensuring you have full context on every deal.

support@yourdomain.tld hello@yourdomain.tld

Your lending criteria, automated. Define your rules—like debt-to-income thresholds, minimum balances, or red-flag transactions—and let our AI instantly assess whether applicants fit your credit box. No more one-size-fits-all; get insights tailored to your lending strategy.

Scale beyond individual reviews. Monitor thousands of accounts at once with real-time status tracking, exception alerts, and performance insights. Our portfolio view ensures you stay proactive, not reactive, with client relationships.

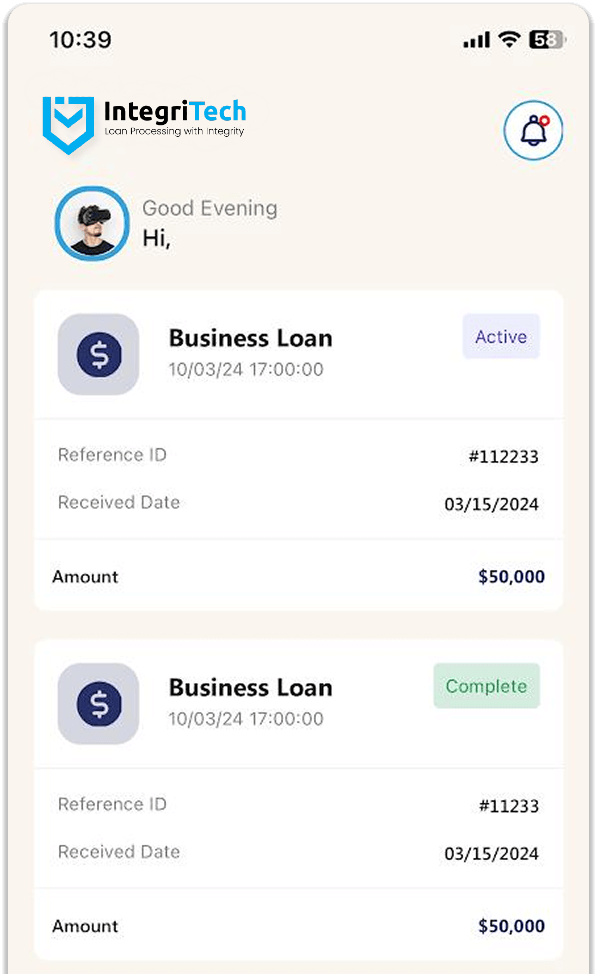

24/7 borrower engagement. Our AI chatbot answers loan questions, guides applicants through document uploads, and provides real-time status updates—freeing your team to focus on closing deals instead of chasing follow-ups.

IntegriTech delivers a smoother borrower journey by automating reminders and status updates. Clients always know what’s next, reducing delays and miscommunication—while your team benefits from faster closings and fewer manual tasks.