Fully Integrated Point-of-sale System

Understand Your Borrowing Eligibility in Minutes not Months!

Instantly understand your SBA and business loan qualifications with AI powered financial analysis.

No application required, no credit impact, and completely free.

Elevate Borrower Experiences and Lending Workflows with AI-Powered Intelligence

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

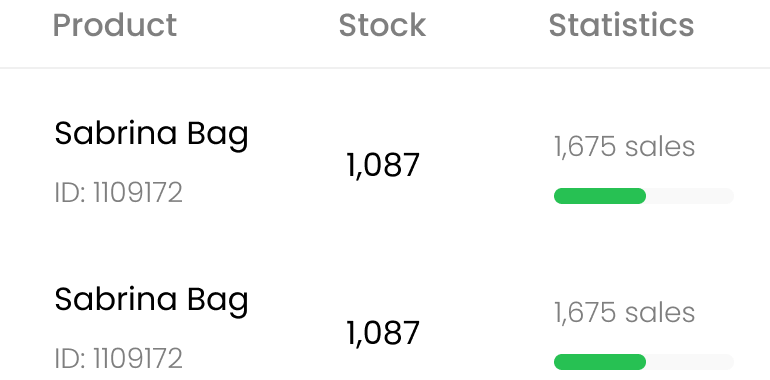

Reduction in inventory holding costs stock management.

Ensuring shorter queues and happier customers.

A Modern SBA Experience Built for Speed,

Clarity, and Automation

From application to underwriting, our platform delivers a faster, clearer SBA lending experience

through automation, secure workflows, and intelligent analysis.

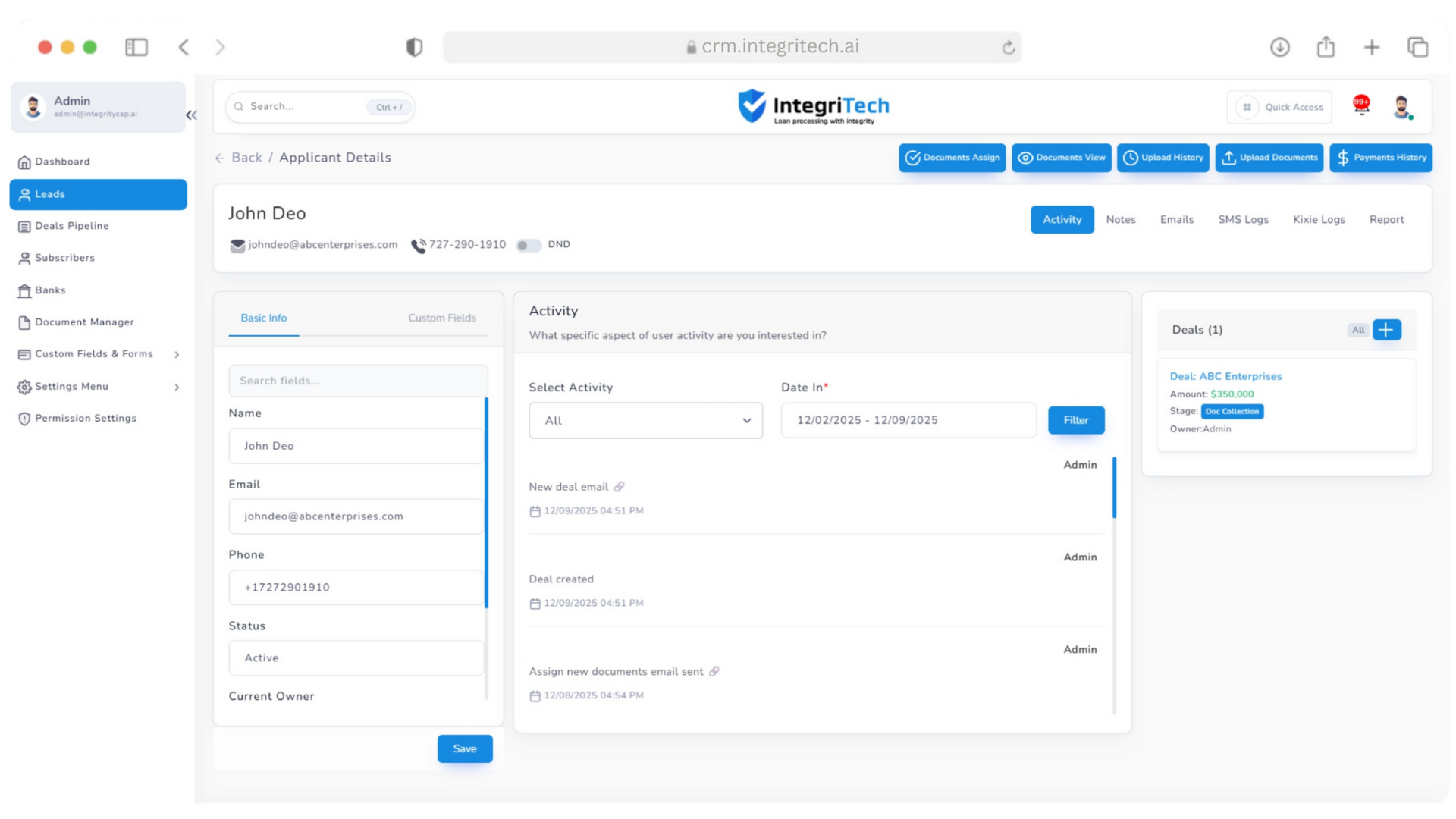

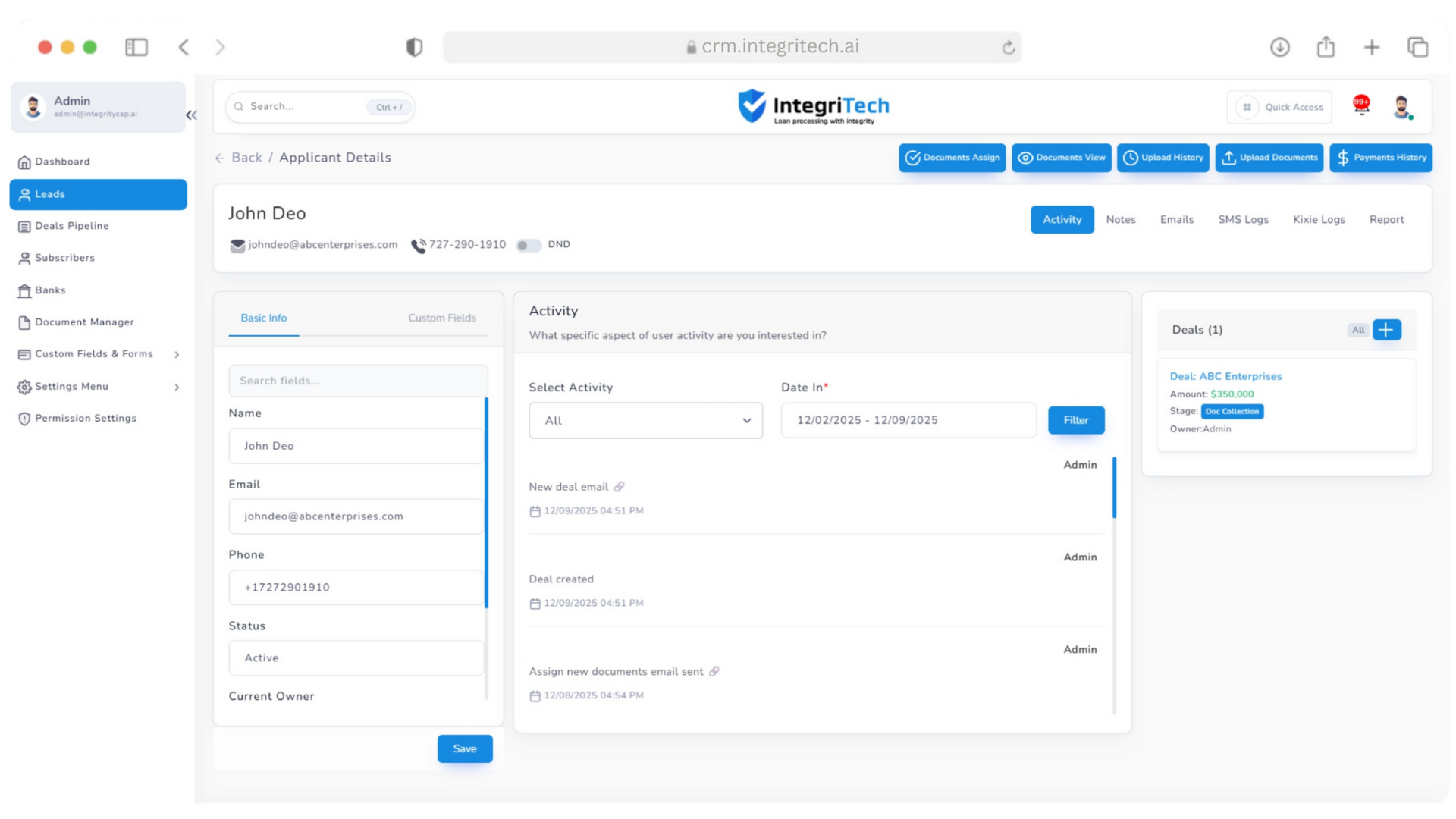

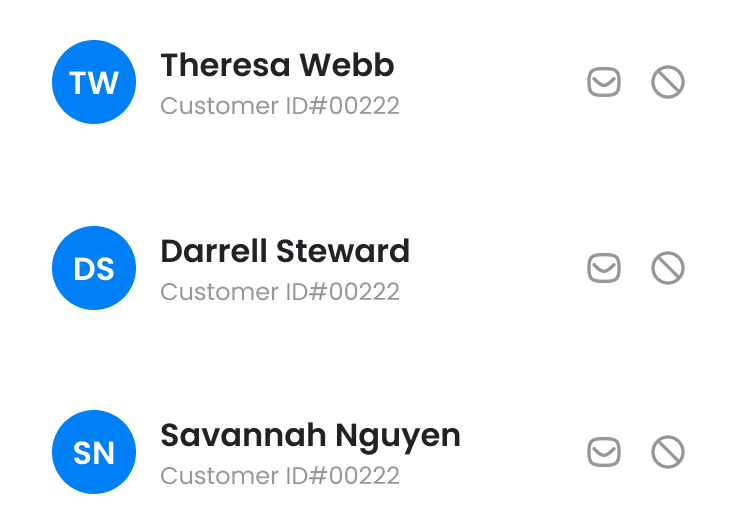

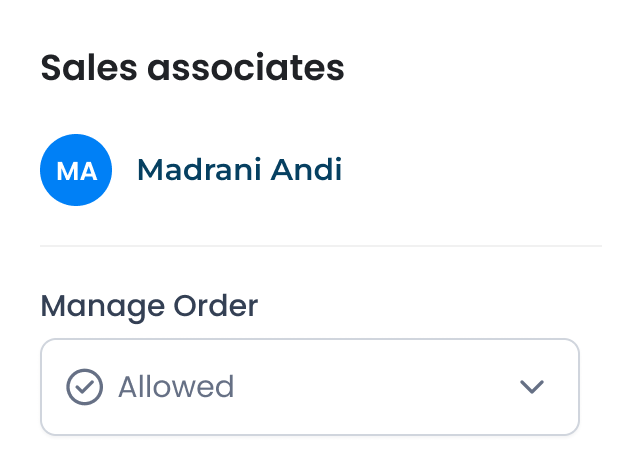

Integrated CRM Workflow

Connect documents to customer records and track each application’s progress in one centralized workspace.

IntegriTech AI Assistant

A 24/7 assistant that guides borrowers, answers common questions, and provides real-time status updates.

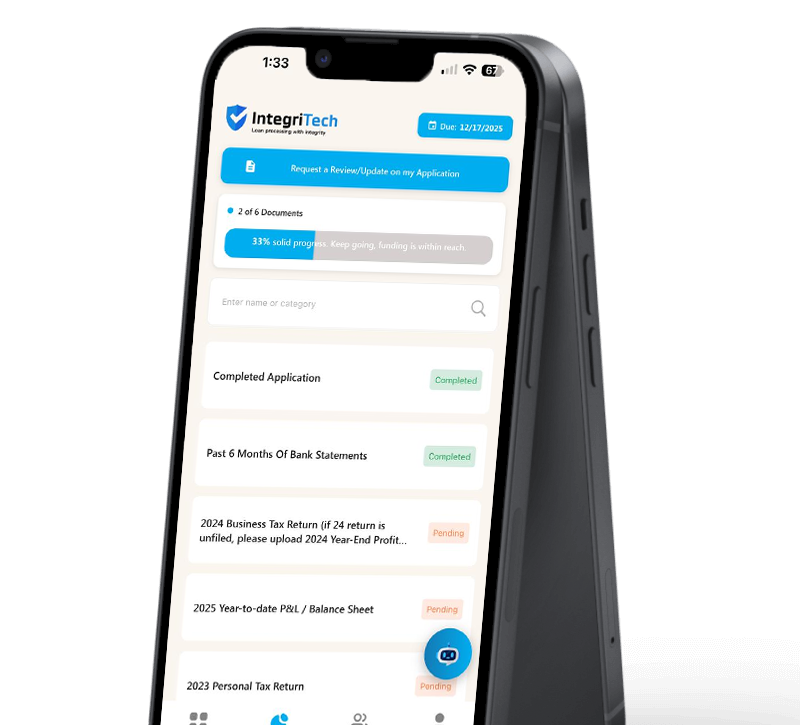

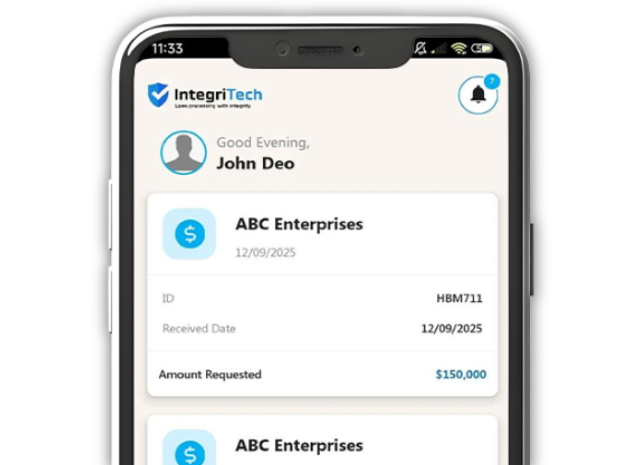

Secure Applicant Portal

Give borrowers a central hub to upload documents, track progress, and communicate securely with your team.

Modern SBA Application

Automated Document Analysis

Powering Modern Lending with Intelligent Automation

We’re proud to be democratizing SBA access with the nation’s first real-time eligibility checker.

Making funding faster, fairer, and more transparent for everyone.

Matthew Carlucci

Founder & CEO, Integritycap & IntegriTech

AI-Powered Document Intelligence

Turn hours of document review into minutes with automated extraction, verification, and fraud detection.

Enterprise-Grade Security with MFA & Audit Trails

Safeguard sensitive data with bank-level encryption, multi-factor authentication, and complete visibility into every action.

Smart Pipeline & Deal Stages

Track every borrower journey with customizable stages that keep deals moving and teams aligned.

Real-Time Team Collaboration

Accelerate decision-making with shared deal notes, stage updates, and real-time activity feeds, keeping everyone aligned from intake to funding.

Secure SBA Portal

IntegriTech AI Assistant

Powering Modern Lending with Intelligent Automation

We’re proud to be democratizing SBA access with the nation’s first real-time eligibility checker. Making funding faster, fairer, and more transparent for everyone.

Matthew Carlucci

Founder & CEO, Integritycap & IntegriTech

AI-Powered Document Intelligence

Turn hours of document review into minutes with automated extraction, verification, and fraud detection.

Enterprise-Grade Security with MFA & Audit Trails

Safeguard sensitive data with bank-level encryption, multi-factor authentication, and complete visibility into every action.

Smart Pipeline & Deal Stages

Track every borrower journey with customizable stages that keep deals moving and teams aligned.

Real-Time Team Collaboration

Accelerate decision-making with shared deal notes, stage updates, and real-time activity feeds, keeping everyone aligned from intake to funding.

Tailored POS Solutions for Your Unique Store

- Multi Store

- Single Store

- Restaurant

- Appointment

Powering Modern Lending with Intelligent Automation

AI-Powered Document Intelligence

Turn hours of document review into minutes with automated extraction, verification, and fraud detection.

Enterprise-Grade Security with MFA & Audit Trails

Safeguard sensitive data with bank-level encryption, multi-factor authentication, and complete visibility into every action.

Smart Pipeline & Deal Stages

Track every borrower journey with customizable stages that keep deals moving and teams aligned.

Real-Time Team Collaboration

Accelerate decision-making with shared deal notes, stage updates, and real-time activity feeds, keeping everyone aligned from intake to funding.

Powering Modern Lending with Intelligent Automation

AI-Powered Document Intelligence

Turn hours of document review into minutes with automated extraction, verification, and fraud detection.

Enterprise-Grade Security with MFA & Audit Trails

Safeguard sensitive data with bank-level encryption, multi-factor authentication, and complete visibility into every action.

Smart Pipeline & Deal Stages

Track every borrower journey with customizable stages that keep deals moving and teams aligned.

Real-Time Team Collaboration

Accelerate decision-making with shared deal notes, stage updates, and real-time activity feeds, keeping everyone aligned from intake to funding.

Powering Modern Lending with Intelligent Automation

AI-Powered Document Intelligence

Turn hours of document review into minutes with automated extraction, verification, and fraud detection.

Enterprise-Grade Security with MFA & Audit Trails

Safeguard sensitive data with bank-level encryption, multi-factor authentication, and complete visibility into every action.

Smart Pipeline & Deal Stages

Track every borrower journey with customizable stages that keep deals moving and teams aligned.

Real-Time Team Collaboration

Accelerate decision-making with shared deal notes, stage updates, and real-time activity feeds, keeping everyone aligned from intake to funding.

Powering Modern Lending with Intelligent Automation

AI-Powered Document Intelligence

Turn hours of document review into minutes with automated extraction, verification, and fraud detection.

Enterprise-Grade Security with MFA & Audit Trails

Safeguard sensitive data with bank-level encryption, multi-factor authentication, and complete visibility into every action.

Smart Pipeline & Deal Stages

Track every borrower journey with customizable stages that keep deals moving and teams aligned.

Real-Time Team Collaboration

Accelerate decision-making with shared deal notes, stage updates, and real-time activity feeds, keeping everyone aligned from intake to funding.

Why Choose Us

Elevating Lending Through Technology

IntegriTech empowers lenders with AI automation and centralized data, replacing time-consuming manual work with intelligent workflows that accelerate loan decisions, enforce compliance, and minimize risk across every stage of lending.

Portfolio Management Dashboard

Monitor thousands of accounts with real-time insights, alerts, and performance tracking, helping your team stay proactive.

Integritech AI Assistant

24/7 borrower support with an AI chatbot that answers questions, guides document uploads, and provides real-time updates.

Automated Follow-Ups & Reminders

Keep borrowers on track with automated reminders, status updates, and next-step notifications, reducing delays and manual outreach.

Powering the Future of Economic Technology

Enabling referral partners, lenders and banks to unlock new levels of digital efficiency and scalability.

Get the Details on IntegriTech

SBA Lending

No. Our SBA eligibility check is soft and has zero impact on your credit score.

In minutes. Traditional SBA reviews take months, but IntegriTech delivers instant clarity using AI-powered eligibility checks.

You’ll get access to your Applicant Portal, where you can upload documents, track your application status, and communicate with our team.

Yes, our embedded Helper functionality allows you add document support personnel, including other owners.

To begin eligibility, just basic business and owner details are needed. You’ll later upload required documents like tax returns, bank statements, and financial reports through the portal

Absolutely. You can upload tax returns, bank statements, and supporting docs directly into your secure portal or through our IntegriTech AI Assistant.