Years of experience in the industry, expertise to perfection.

IntegriTech is built on the belief that financial progress shouldn’t be held back by manual, outdated workflows. We streamline lending with intelligent automation that accelerates decisions and improves borrower experiences.

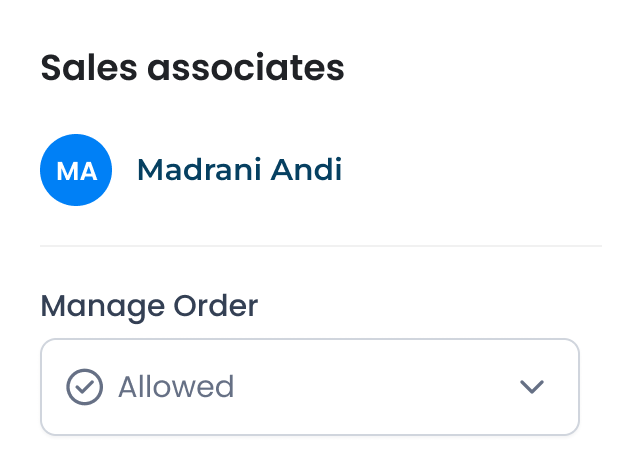

We create intuitive, borrower-friendly and lender-friendly workflows that make lending smoother for everyone.

We stand behind our technology and partners, delivering dependable tools that support consistent lending performance.

We push for innovation and quality in every part of our platform, raising the standard for modern lending automation.

We safeguard your data and your business with secure, ethical technology you can trust at every step.

Years of experience in the industry, expertise to perfection.

Our customer satisfied retention rate stands impressive.

Developed customized solutions for unique business needs.

Security track record, safeguarding sensitive information.

IntegriTech is an AI-powered loan processing platform that transforms how lenders and borrowers experience lending. We automate document collection and analysis, centralize borrower data in a secure portal, apply custom credit rules for faster underwriting, and deliver portfolio-wide visibility with built-in compliance.

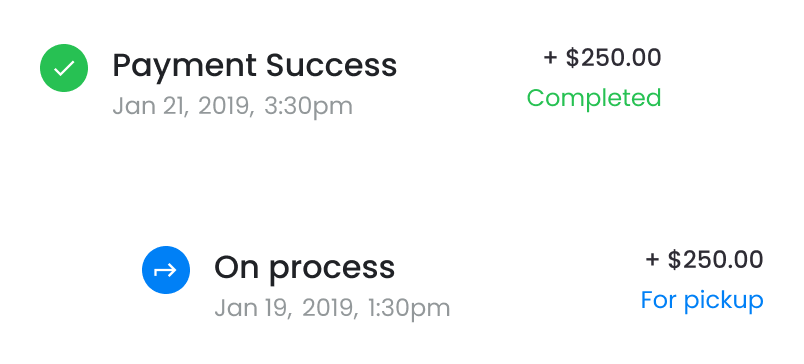

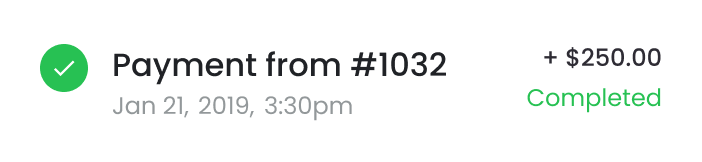

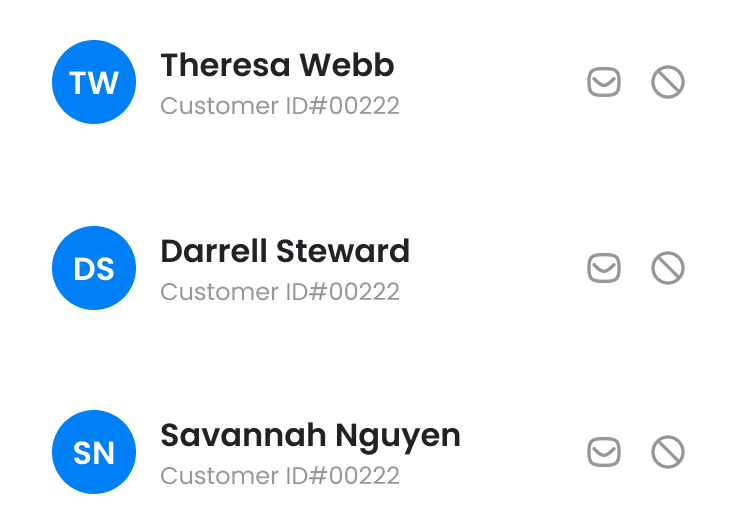

All borrower data, documents, and communications stored in one secure hub with real-time visibility for both lenders and applicants.

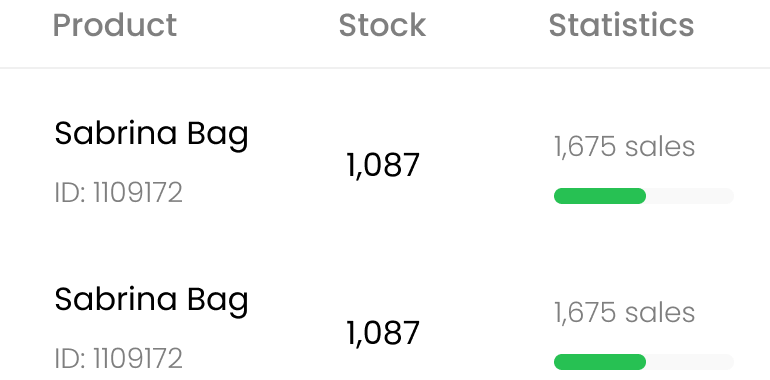

Gain complete visibility into every account with live tracking, compliance alerts, and performance insights that help you scale confidently.

Automate credit decisions with AI that applies your policies consistently, flags exceptions instantly, and accelerates approvals.